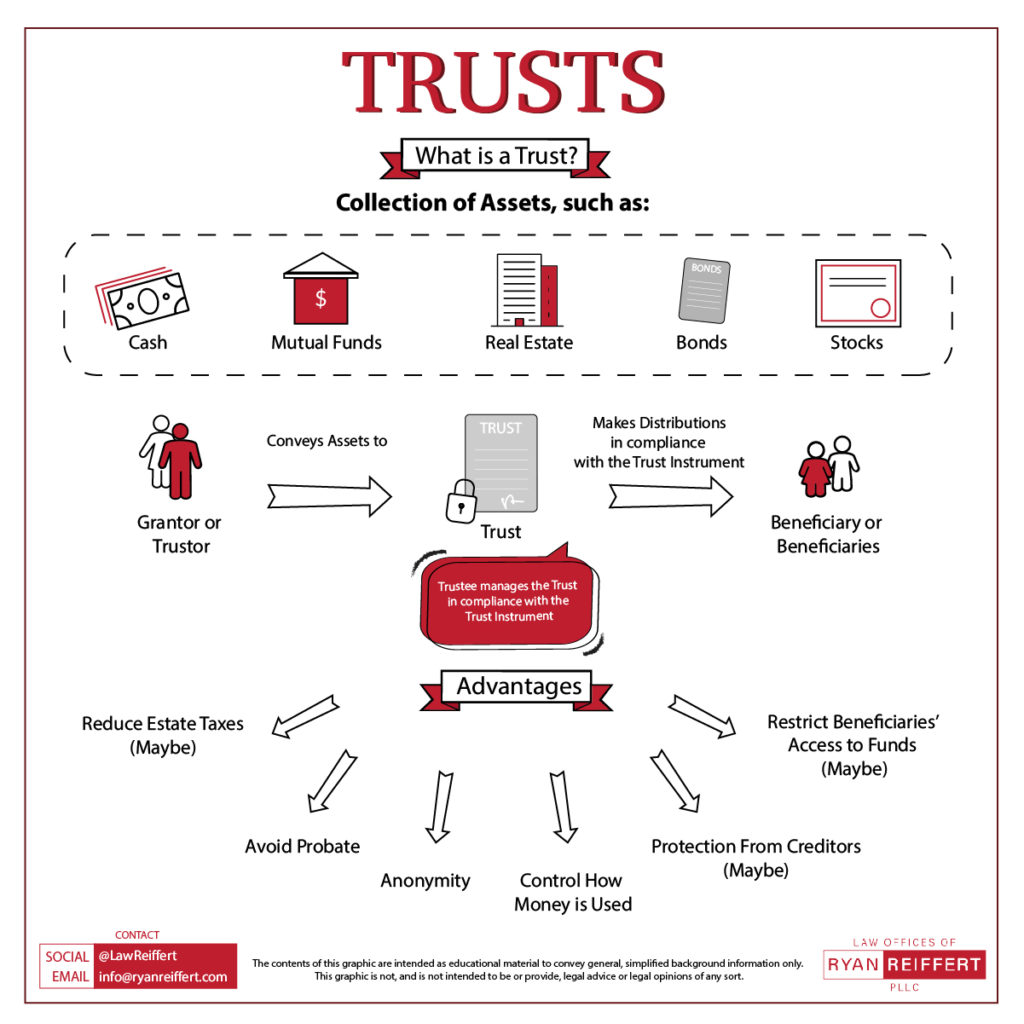

39 credit shelter trust diagram

A credit shelter trust is a type of trust fund that allows married couples to reduce estate taxes by taking full advantage of state and federal estate tax exemptions. As such, it's generally only...

The decedent's will specifically provided that the IRA was to pass to a trust for the benefit of the decedent's spouse during his life (Trust 1). Upon the death of the decedent's spouse, the assets of Trust 1 were to pass to another trust (Trust 2) of which the children were the beneficiaries.

Jun 24, 2021 — Credit shelter trusts are trusts for affluent couples to minimize or avoid their estate tax liabilities by passing on proceeds from individual ...Understanding a Credit... · Benefits of a Credit Shelter...

Credit shelter trust diagram

Credit Shelter Trust Diagram — A credit shelter trust is a tool used by affluent couples to reduce or avoid estate tax liabilities that is as a result of ...

The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) slams shut a valuable income-tax benefit for most inherited IRAs. A clear result of the SECURE Act is that the "stretch" inherited IRA is now unavailable for most beneficiaries other than a surviving spouse, and a 10-year payout is the new norm. The adage is that "where one door closes, another opens ...

Enter the ABC Trust system of estate planning for married couples, also known as "gap trust planning" and making the "state QTIP election." A handful of states allow the payment of both federal and state estate taxes to be deferred until after the surviving spouse's death. So let's take a look at how an ABC Trust plan may work for your estate.

Credit shelter trust diagram.

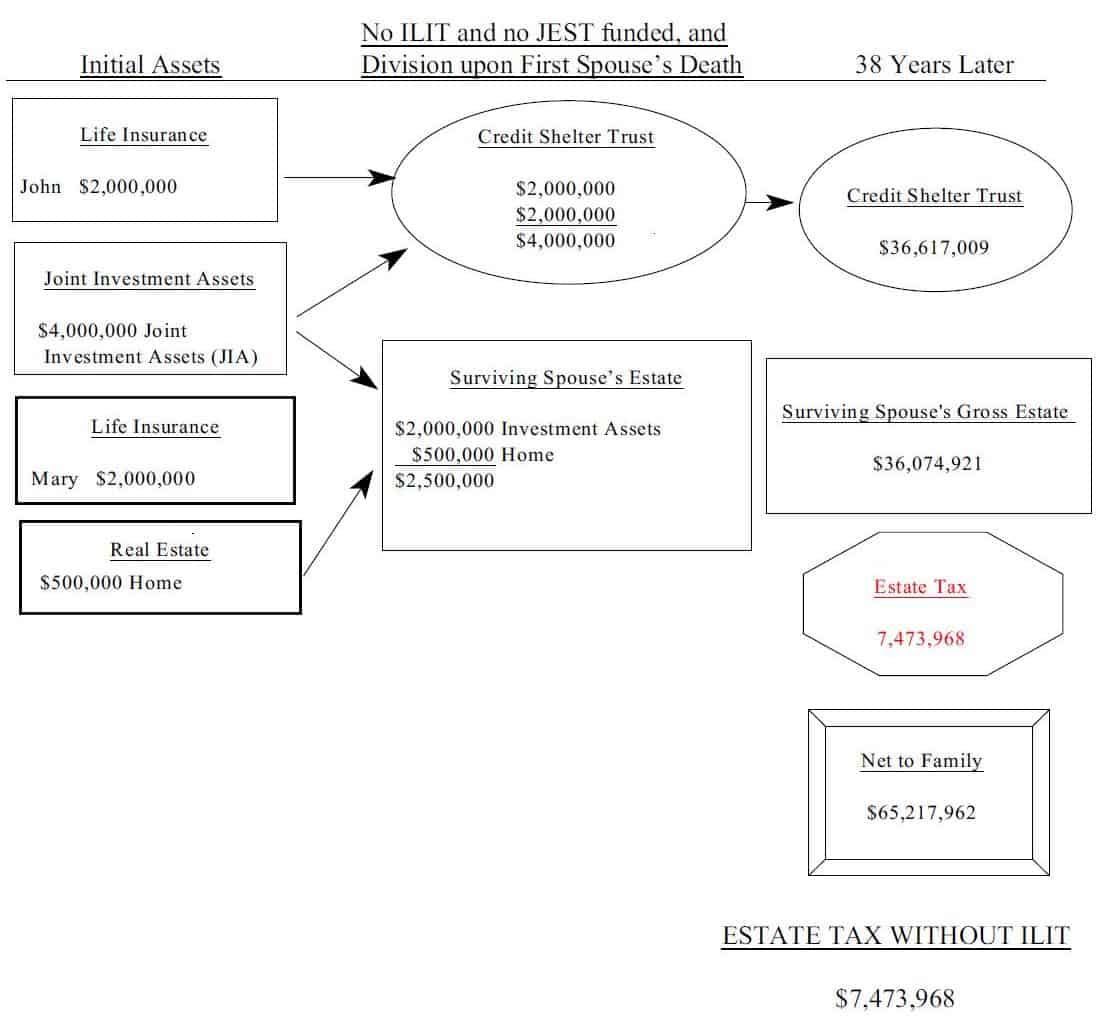

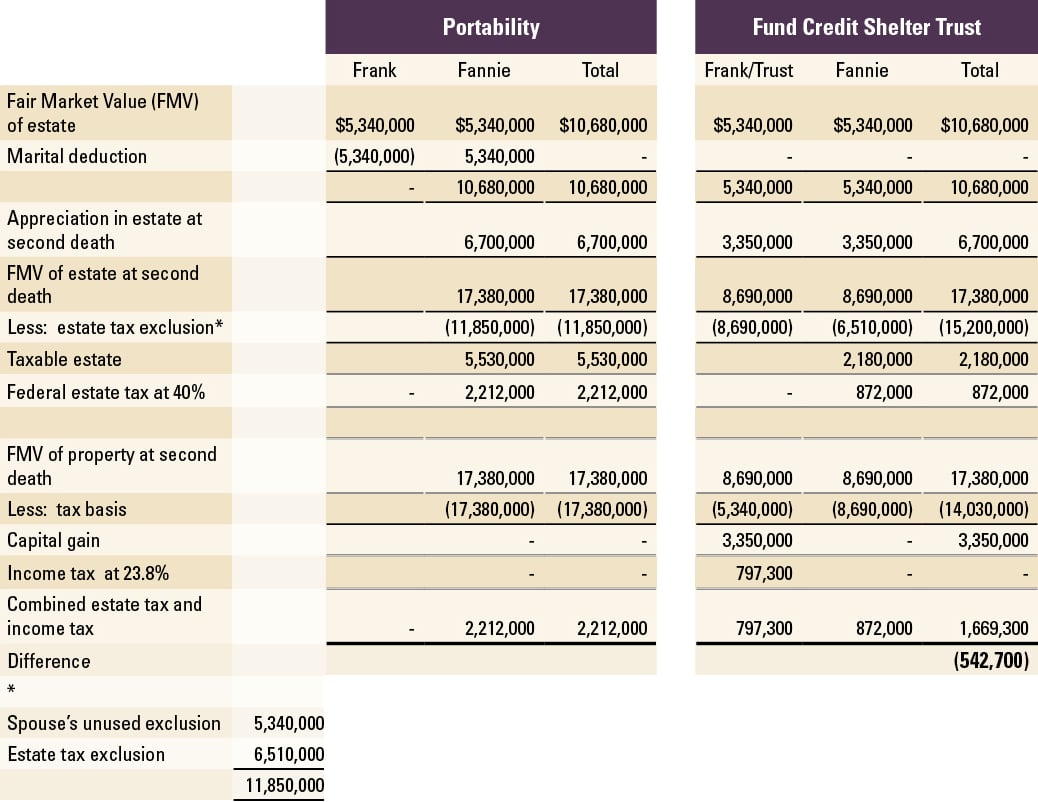

The credit shelter trust also can shield the growth on the federal exclusion while portability only preserves the date of death value of the exclusion. For example, let's assume the deceased spouse died when the exclusion was $5.49 million. Let's further assume asset growth of 6% and a surviving spouse living another 12 years.

B. State and federal Credit Shelter Trusts and federal portability 1. By far the most common tax-motivated marital trust is a Credit Shelter Trust.3 2. Less needed than they were 20 years ago when estate tax exemptions were much lower, Credit Shelter Trusts avoid tax on the first death and assure that both spouses'

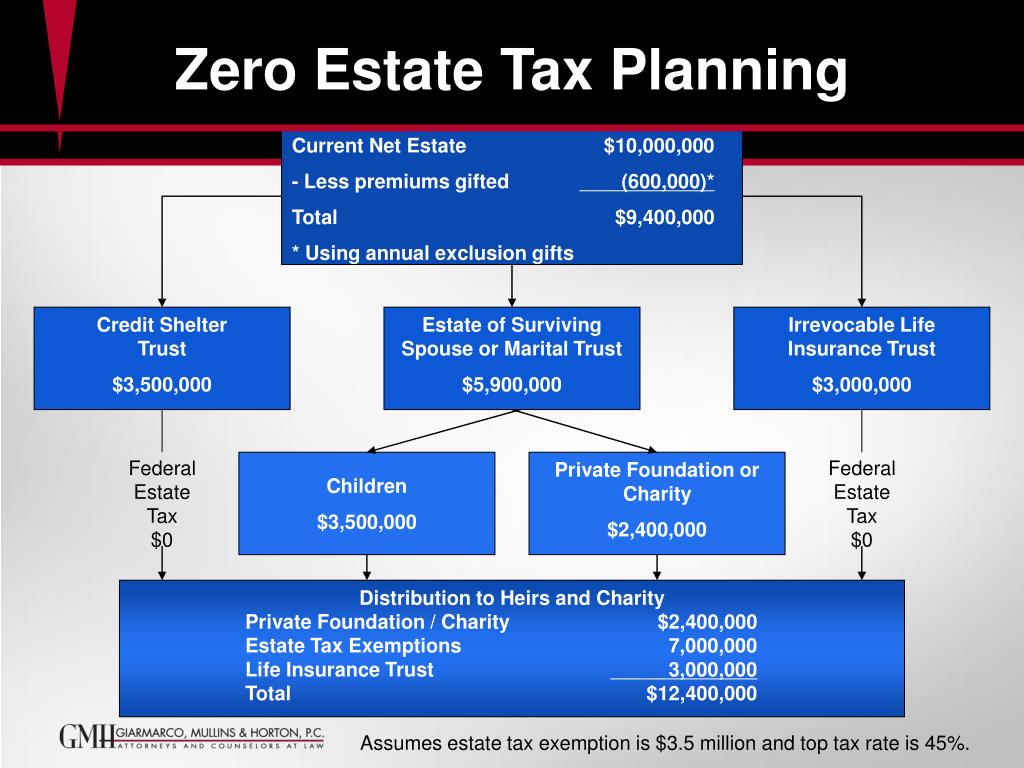

With a credit shelter trust (sometimes called a bypass trust), a donor's will bequeaths to the trust an amount up to the value of the estate tax exemption (currently, $5,250,000). The remainder of the estate is then passed directly to the spouse tax-free using the unlimited marital estate tax deduction.

A bypass trust (also called an "A/B trust" or a "credit shelter trust") was designed to prevent the estate of the surviving spouse from having to pay estate tax.

What is a Credit Shelter Trust? A Credit Shelter Trust, or as it is sometimes called, a "Bypass Trust," Family Trust or "B Trust," is an Irrevocable Trustdesigned to hold an amount that can be sheltered from death taxes. What is the Purpose of a Credit Shelter Trust?

Traditional Trust Types Possibly Incorporated into a SLAT Life insurance trust (ILIT). Dynasty trust. Grandchildren's trust. Children's trust. Asset protection trust. Inter-vivos credit shelter trust. 5 Tax Laws -Permanent Uncertainty The tax laws are uncertain. Will the estate tax be repealed? If repealed, will there be a sunset?

Text in this Example: Spouse leaves everything to surviving spouse Spouse leaves his or her half of estate in a credit shelter trust $4 million estate $4 million for surviving spouse $2.835 million for children $1.5 million credit shelter trust $2.5 million $3.54 million for children No tax at first spouse's death Tax at surviving spouse's death = $1.135 million At surviving spouse's death ...

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Aug 16, 2021 — A credit shelter trust is created after one partner in a marriage dies. Any assets that are put into the trust are considered separate from the ...

For example, an AB Trust divides into the "Survivor's Trust" and the "Decedent's Trust" (or "Credit Shelter Trust"). The Survivor's Trust remains revocable and contains the surviving Settlor's property interest. The Survivor has complete control over the property and can change the ultimate beneficiaries at any time.

A bypass trust (also referred to as a credit shelter trust or a tax exemption trust) is an estate planning tool commonly used in trust designs referred to as "AB Trusts" or "ABC Trusts." In these trust designs the "A" trust (also referred to as a surviving spouse's trust or survivor's trust) grants the surviving spouse full ...

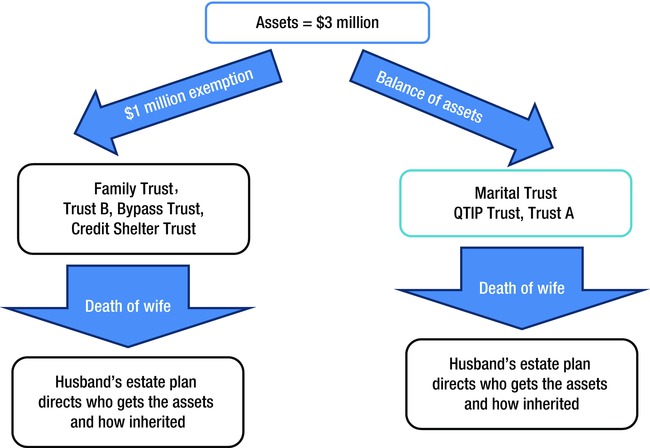

The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust." AB Trusts and Portability of the Estate Tax Exemption

In 2021, only estates over $11.7 million will be taxed. Most people don't have estates valued this high, but if you want to avoid or minimize estate taxes more fully, you can open a credit shelter trust in conjunction with the QTIP trust. Protection from a second spouse. A QTIP trust can be a useful part of an estate plan for a blended family ...

TRUST DISTRIBUTION FLOWCHART. "Credit Shelter Trusts". Someone who has more than $650,000 in assets and married may want to consider this option. The Credit Shelter Trust allows a married couple to leave an estate worth up to $1.3 million without owing taxes. In this hypothetical situation, the couple saved $200,000 through a Credit Shelter Trust.

Once an AB Trust goes into effect, it transforms into both a marital Trust and a bypass Trust. The Marital Trust is another name for the Trust being left to the surviving spouse. A Bypass Trust is the name of the Trust by the deceased spouse, it is sometimes also known as a Family Trust or Credit Shelter Trust.

However, the credit shelter trust does not actually come into being until one spouse dies. At that time, the will or living trust directs the executor or ...

A bypass trust structure often consists of two trusts, commonly called an A/B Trust, in which the federal exclusion amount funds the B Trust and the rest passes to the spouse in an A Trust or directly. Disclaimer Trusts. With a disclaimer trust, a surviving spouse must affirmatively make a timely election to create an A/B or other Trust structure.

There are three wills and trust documents in this product that can be used for estate tax savings trusts. Documents included are: Marital and Credit Shelter Trust Worksheet. Marital and Credit Shelter Trust. Schedule A. These documents are from the publication Estate Planning Forms. Gain instant access to convenient forms, letters, checklists ...

The surviving spouse can also extend tax and credit shelter benefits to his or her heirs. Secondary trusts can hold assets that will be passed on to children or grandchildren. Additionally, holding assets in a bypass trust allows the surviving spouse to avoid probate. That is the legal process overseen by the court system in which a deceased ...

The marital disclaimer trust is similar to a credit shelter trust (CST): Assets placed in the trust are generally held apart from the estate of the surviving spouse, so that the assets may pass tax-free to the remaining beneficiaries when the surviving spouse dies. However, unlike most CSTs, the use of a marital disclaimer trust is optional ...

Peter was very knowledgeable in estate planning matters, able to define the best solution for the situation. Additionally, he was congenial and able to communicate effectively to my senior citizen parents the benefits of estate planning. He earned my trust, and more importantly, my parents' trust in a 45 mins consultation period.

Hw the AB Trust Works (Via Diagram) ... The "B Trust" is referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust." The "A Trust" contains the property of the surviving spouse, and the B trust will contain the deceased spouse's property. The limited control the surviving spouse has will allow him or her ...

Credit shelter trusts are a way to take full advantage of state and federal estate tax exemptions. Although such trusts may appear needless unless you are a multi-millionaire, there are still reasons for those of more modest means to do this kind of planning, and one of the main ones is state taxes.

For married clients, we use diagrams to explain how a credit shelter trust for the surviving spouse may reduce estate taxes. We also discuss the appointment of an executor and directives for health care decisions. For clients have minor children, we address issues concerning guardians and distribution of funds in trust for children. 3. Draft ...

USE OF A FAMILY TRUST. Before the unused exclusion was portable, the exclusion amount could be sheltered from estate taxes by placing the exclusion amount in a family trust, also called a bypass trust or a credit-shelter trust. The family trust would be set up to benefit the surviving spouse during his or her lifetime and, upon the surviving spouse's death, the trust assets would pass to ...

Federal tax laws can seem complicated, even more so when it comes to passing on estate tax exemptions. A credit shelter trust is the perfect instrument to ensure a legally married couple passes their full estate tax exemptions on to heirs. Learn more from the Business Owner's Playbook.

0 Response to "39 credit shelter trust diagram"

Post a Comment