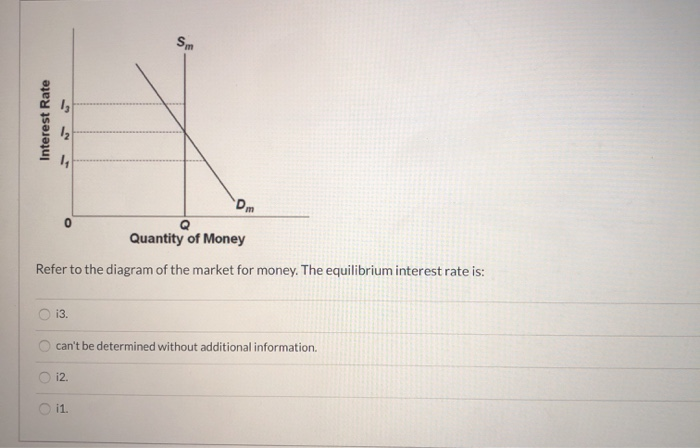

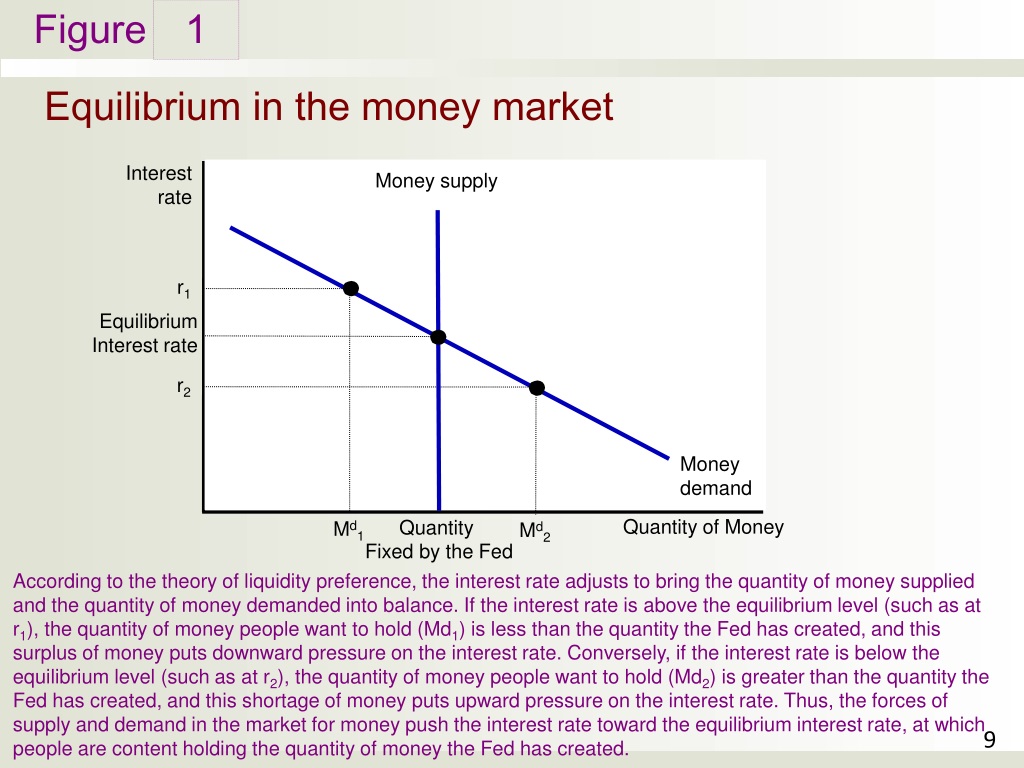

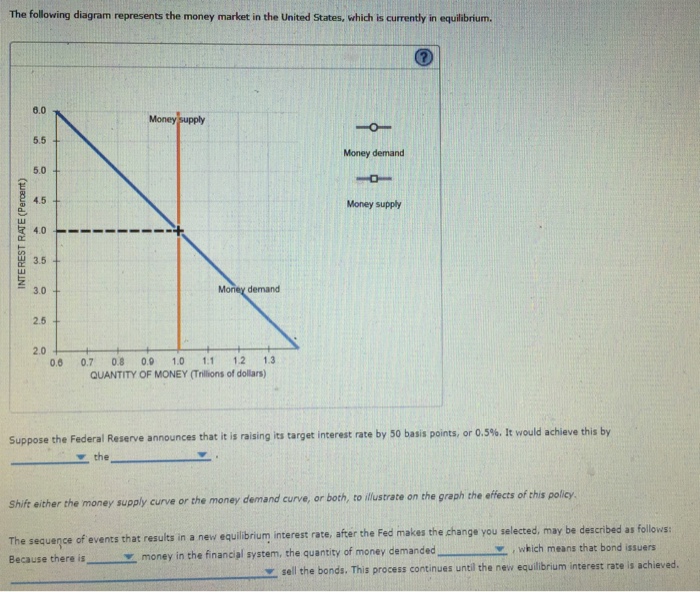

40 refer to the diagram of the market for money. the equilibrium interest rate is

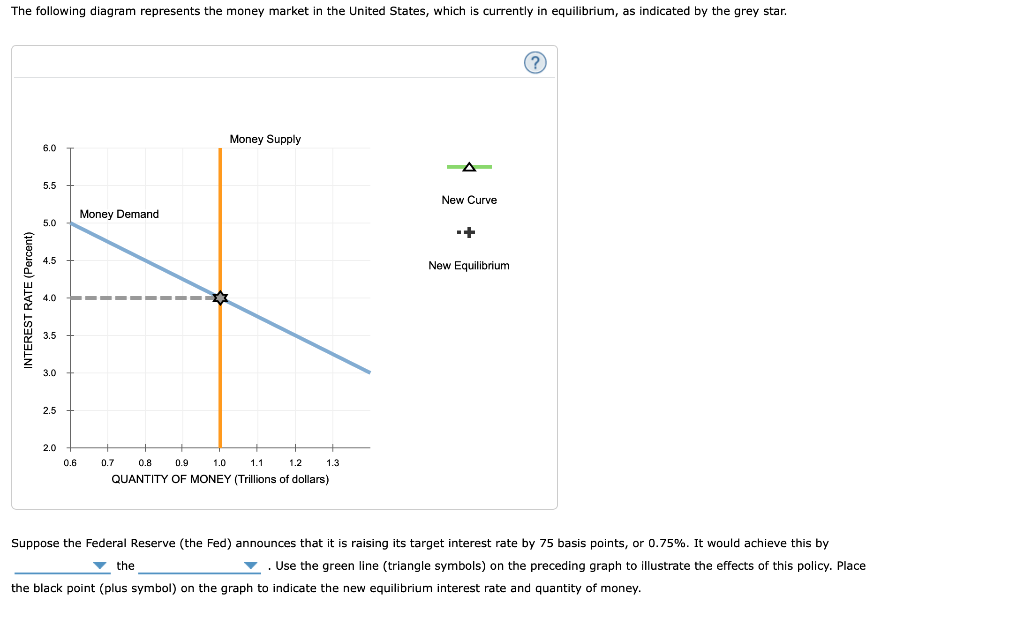

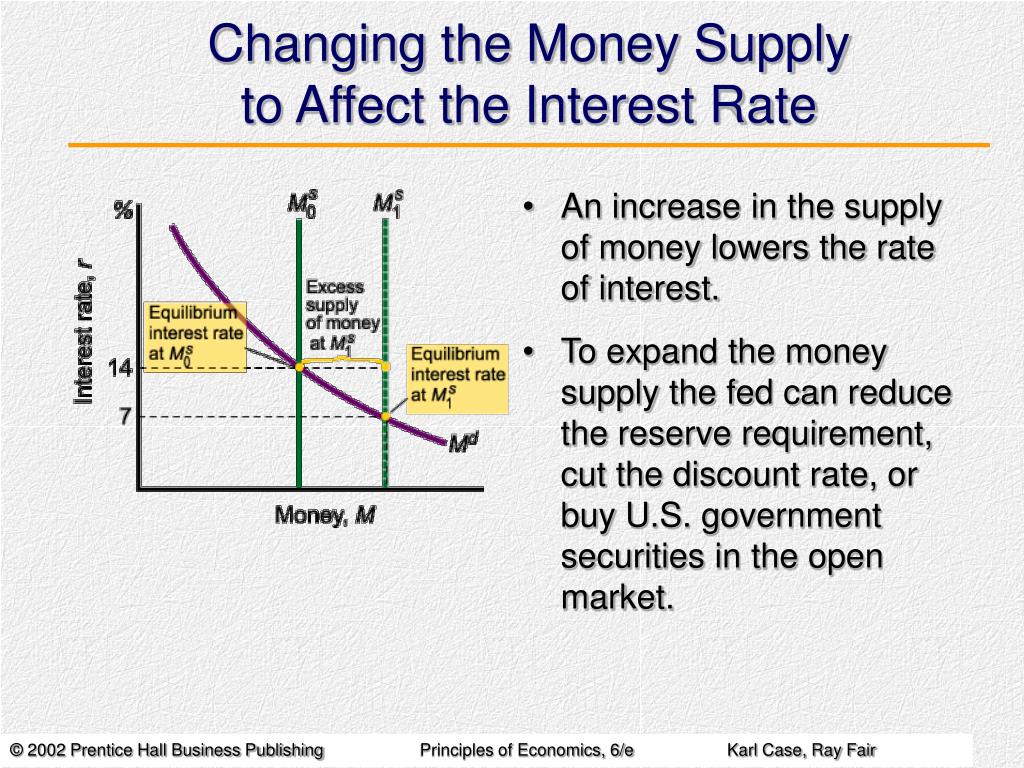

The research has now been completed. This book is the first account of the findings published for general readership. It is with genuine pride and pleasure that Potomac Associates joins with The Club of Rome and the MIT research team in the publication of The Limits to Growth . ... Refer to the above market for money diagrams. If the Federal Reserve increased the stock of money, the: S curve would shift leftward and the equilibrium interest rate would rise. S curve would shift rightward and the equilibrium interest rate would fall. D 3 would shift leftward and the equilibrium interest rate would fall.

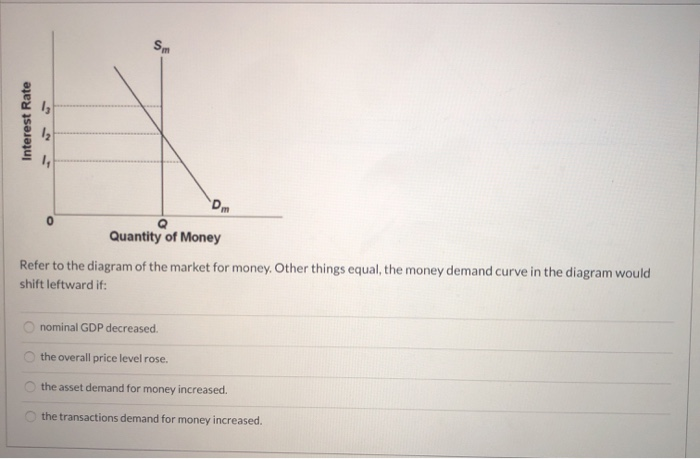

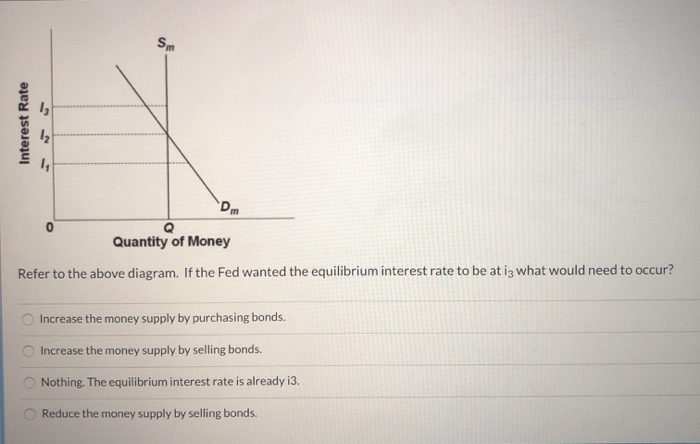

Refer to the diagram of the market for money. Given Dm and Sm, an interest rate of i3 is not sustainable because the: demand for bonds in the bond market will rise and the interest rate will fall.

Refer to the diagram of the market for money. the equilibrium interest rate is

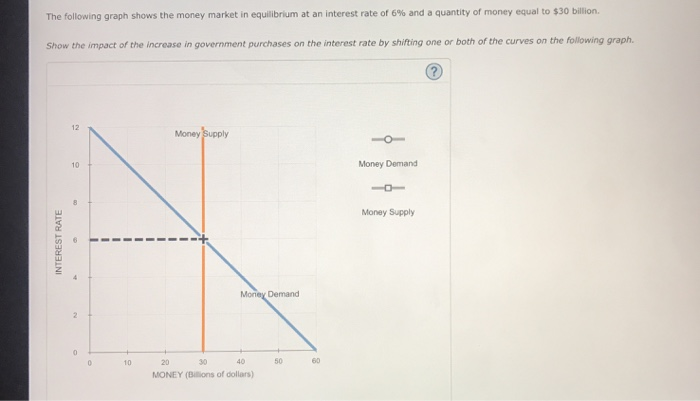

Refer to the given market-for-money diagrams. If the Federal Reserve increased the stock of money, the D3 curve would shift leftward and the equilibrium interest rate would rise. S curve would shift leftward and the equilibrium interest rate would rise. S curve would shift rightward and the equilibrium interest rate would fall. Refer to the diagram of the market for money. Given Dm and Sm, an interest rate of i3 is not sustainable because the: demand for bonds in the bond market will rise and the interest rate will fall. Refer to the graph below, in which D t is the transactions demand for money, D m is the total demand for money, and S m is the supply of money. If the market for money is in equilibrium at a 6 percent rate of interest and the money supply increases, then S m2 will shift to: A) S m3 and the interest rate will be 4 percent. B) S m3 and the interest rate will be 8 percent.

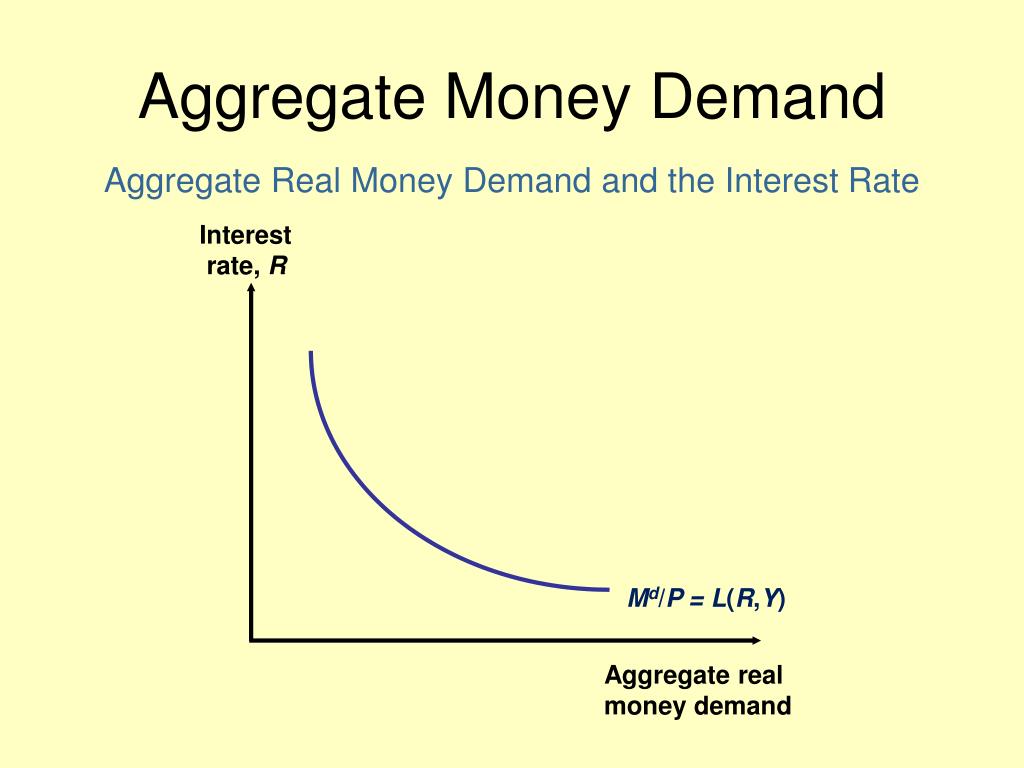

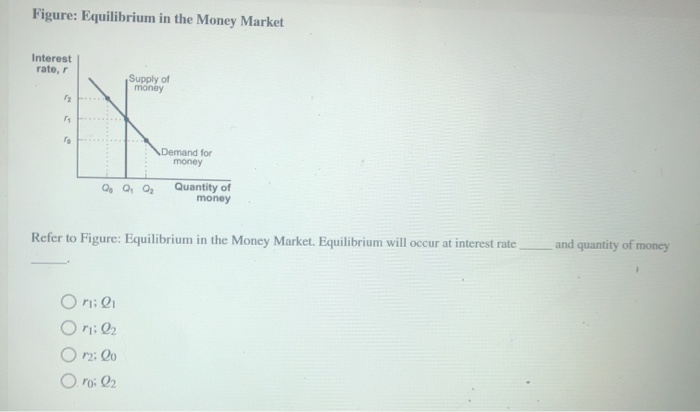

Refer to the diagram of the market for money. the equilibrium interest rate is. the money market, with the price level is normalized to 1: MD = Y L(i) M = MS = MD On the graph, show what happens if income increases. In terms of the new equilibrium, what is the effect of the increase in Y on the interest rate i? Answer: When income goes up, the money demand curve shifts out, causing the equilibrium interest rate in the ... The LM curve represents the combinations of income and the interest rate at which the money market is in equilibrium. If money demand does not depend on the interest rate, then we can write the LM equation as M/P = L(Y). For any given level of real balances M/P, there is only one level of income at which the money market is in equilibrium. Thus, Low-interest rates have made things very difficult for savers over the last decade since the economic crash of 2008. Banks paid very low rates on savings due to an environment in which the benchmark rates were around zero for most of the ti... 40. On a diagram where the interest rate and the quantity of money demanded are shown on the vertical and horizontal axes respectively, the transactions demand for money can be represented by: A. a line parallel to the horizontal axis. B. a vertical line. C. a downsloping line or curve from left to right. D. an upsloping line or curve from left ...

Finding a safe place to save your money is a priority but, if it can earn you high-interest, it’s that much more beneficial. Looking at online savings accounts interest rates will net you the highest interest on your savings accounts becaus... happened to real interest rates? Box A1: Global real rates in an historical context Box A2: Which interest rates... long-term market rates is symptomatic of a fall in the global neutral rate. The global neutral rate is an important policy variable as it acts as an anchor for a country’s equilibrium real rate in the long run... Growing wealth can be a challenge, especially when it comes to choosing the right kind of accounts for stashing your savings. Money markets offer some distinct advantages, but those advantages may not be entirely relevant if you want to max... If the Data is materially transformed by the user, this must be stated explicitly along with the required source citation. For Data compiled by parties other than the World Economic Forum, users must refer to these parties’ terms of use, in particular concerning the attribution, distribution, and reproduction of the Data....

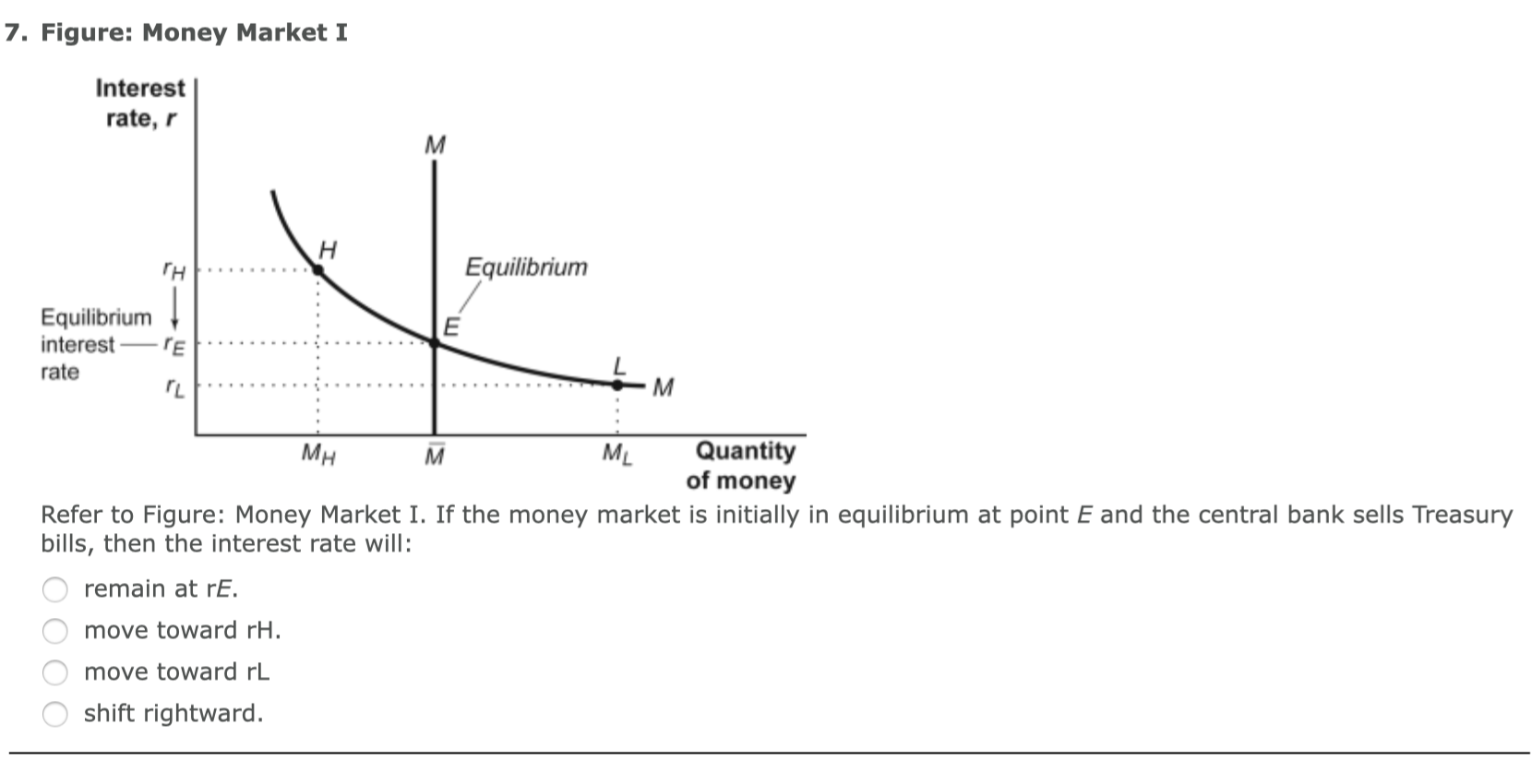

In 2019, just before going to No10, I wrote about the likely failure of UK crisis response in the next big crisis, e.g likely collapse of COBR and the 1914 Cabinet Room: #33: High performance government, ‘cognitive technologies’, & ‘Seeing Rooms’ If interested in why I decided to roll the dice and go to No10 in July 2019 A) There is no effect on NS or ID, and the interest rate remains at i*. B) National saving shifts to NS1 and the interest rate falls to i3. C) Investment demand shifts to I1D, and the interest rate rises to i2. D) The real interest rate rises because of the decrease in the budget surplus. In the diagram above, R* is the interest rate in which the demand for money is exactly equal to the supply of money (again for a given Y). The IS-LM model, R will always tend to R* until they are equal and we have an equilibrium in the money market. The justification for why R will tend to R* is not entirely straightforward: • Say that R < R*. A classic one of those is an unsustainable rate of debt growth that supports the buying of investment... money is printed to hold interest rates significantly below inflation rates. In paradigm shifts, most people... essential for one’s well-being as an investor and beyond. The purpose of this piece is to show you market and...

1/133 EIOPA-BoS-19/408 12 September 2019 Technical documentation of the methodology to derive EIOPA’s risk-free interest rate term structures Changes since the... Market data for government bonds ......................................... 77 12.B. Financial market data for assets other than government bonds .. 77 12.B.1....

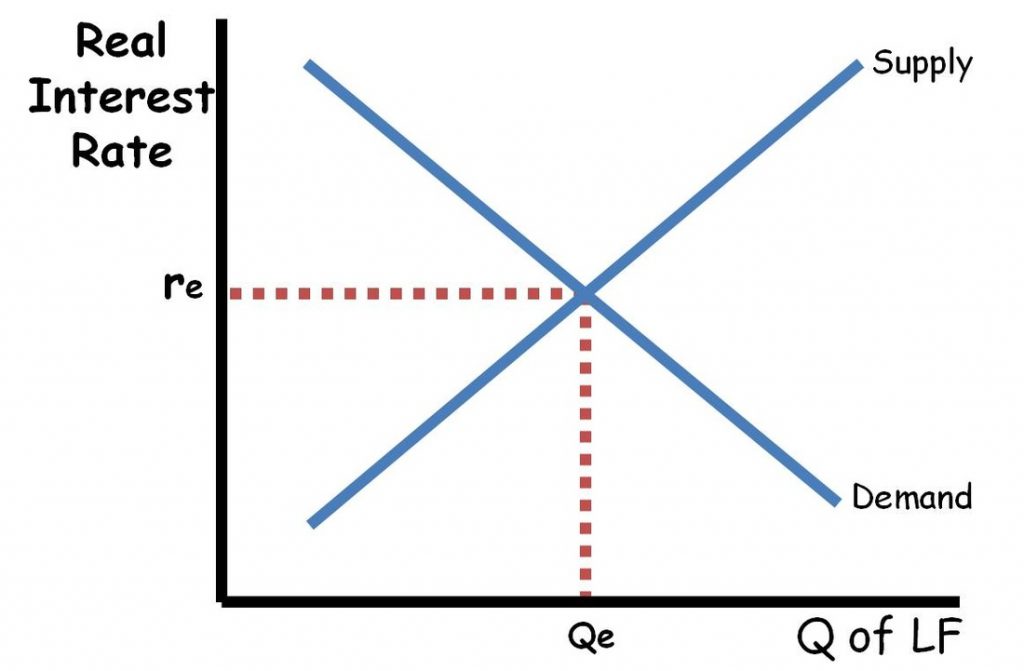

In the long run, economists assume that nominal interest rates will tend toward some equilibrium, or... tend to depress or stimulate economic growth; financial market participants are interested because it would be... level of potential GDP, which is assumed to be unrelated to the real interest rate for this diagram. (In...

My first bank account was at a credit union, where checking and savings accounts had funny names like "share" and "share draft." It was at that credit Best Wallet Hacks by Jim Wang Updated February 5, 2021 Some links below are from our spon...

The interest rate at which demand and the supply for money is equal is known as equilibrium interest rate. The equilibrium interest rate is more likely to be affected by the monetary adjustments or the income levels.By using these rates, the reserves can alter the money flow in the economy so as to maintain the efficient situation in the market.

D) increase the equilibrium interest rate and decrease equilibrium money holdings. 32) Refer to Figure 11.3. At an interest rate of 6%, there is a 32) A) surplus of money and the interest rate will decline. B) shortage of money and the interest rate will decline. C) surplus of money and the interest rate will rise.

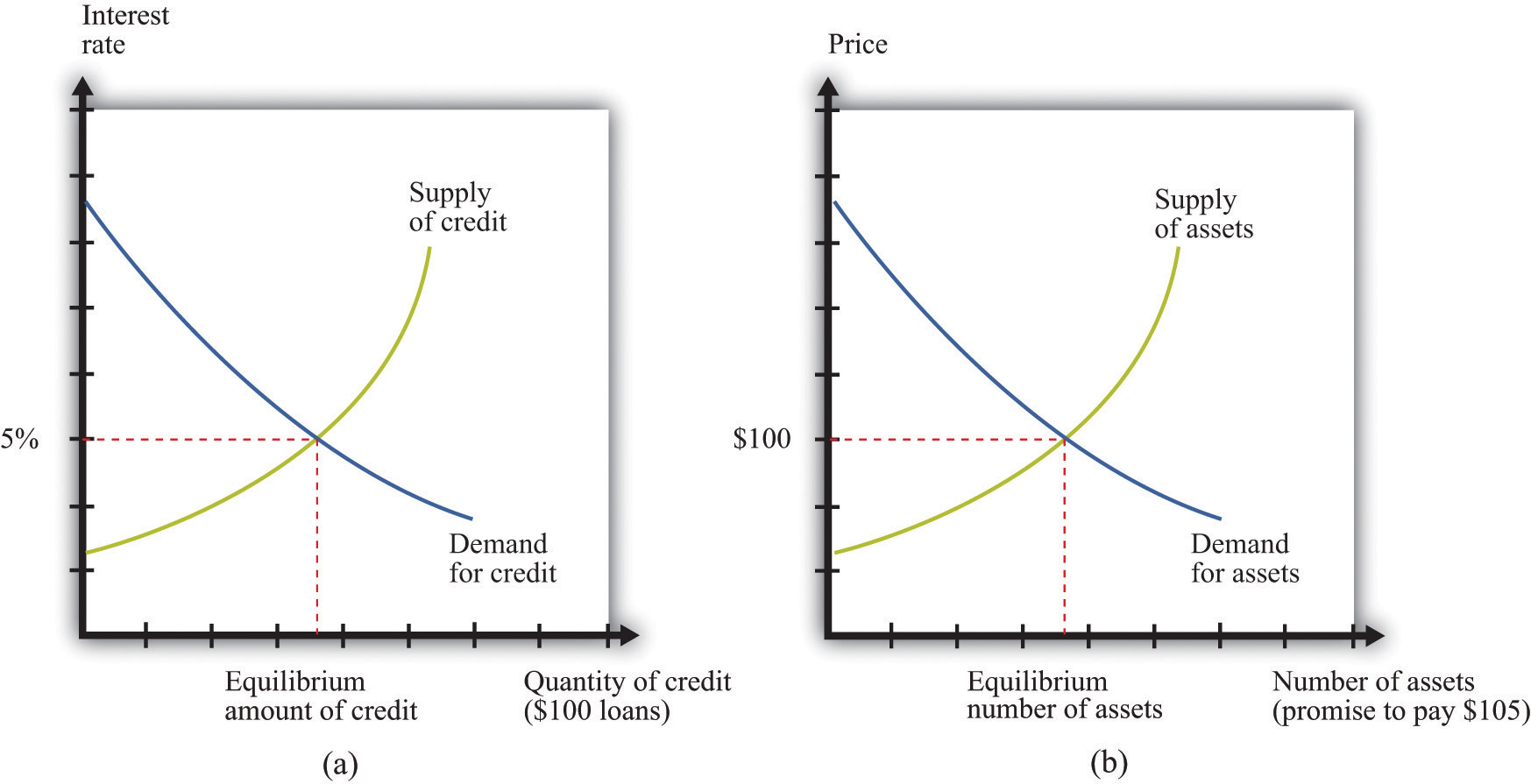

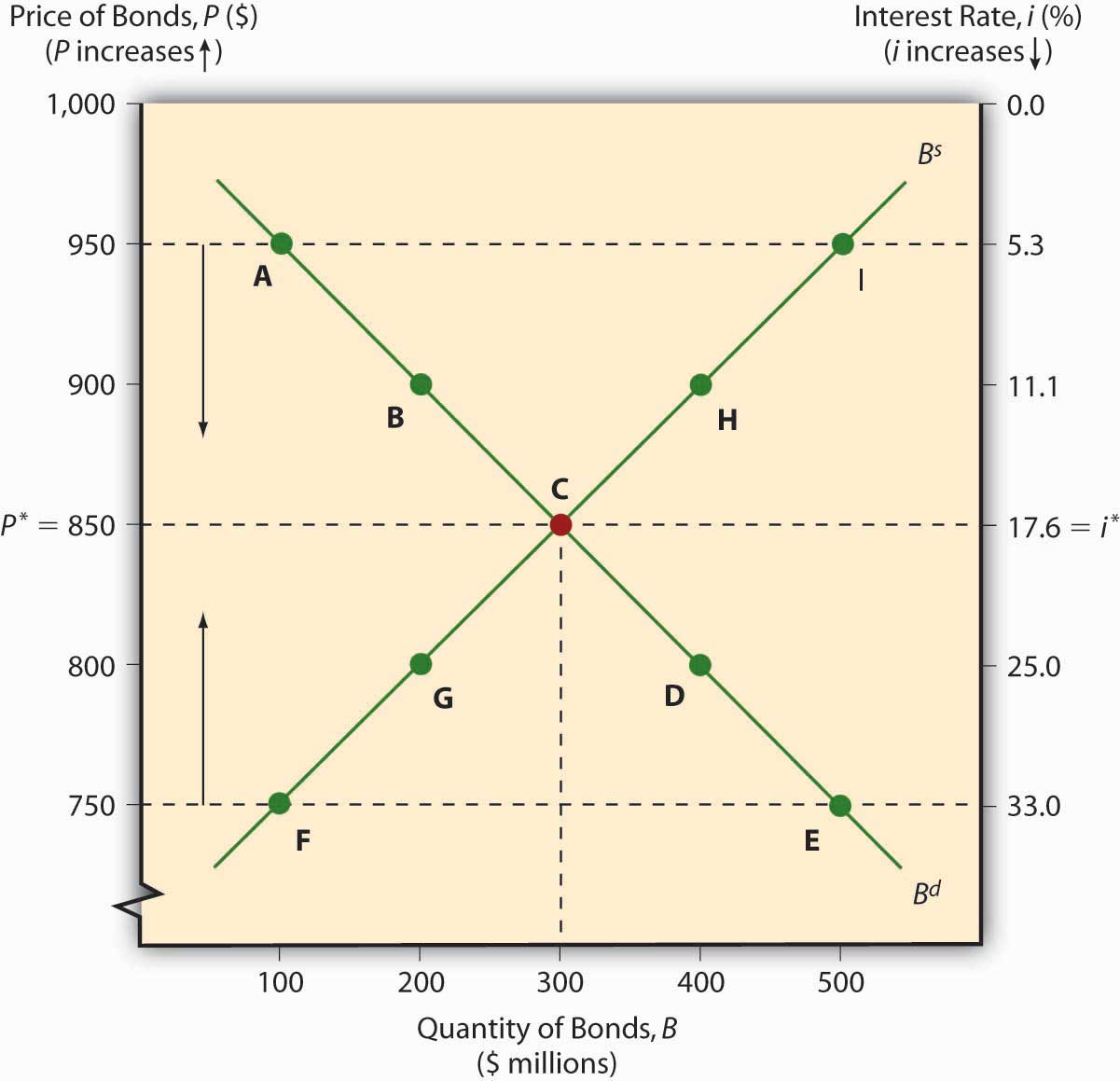

Figure 25.12 An Increase in the Money Supply. The Fed increases the money supply by buying bonds, increasing the demand for bonds in Panel (a) from D1 to D2 and the price of bonds to Pb2. This corresponds to an increase in the money supply to M ′ in Panel (b). The interest rate must fall to r2 to achieve equilibrium.

So it is a sort of grim privilege for the generations living today to watch the slow demise of such a spectacularly effective intellectual construct. The Age of... stock market numbers. But one quality makes gravity dominate at large space-time scales: gravity affects all masses and is always attractive, never repulsive. So...

Introduction The Australian housing market shows strong relationships between interest rates, investment, rents... However, in discussing housing-specific issues, it is not desirable to have important results driven by assumptions for which evidence is weak. We do not constrain the steady state of our model except when the data...

156. Refer to the above diagram of the money market. Given Dm and Sm, an interest rate of i3 is not sustainable because the: A) supply of bonds in the bond market will decline and the interest rate will rise. B) supply of bonds in the bond market will increase and the interest rate will decline.

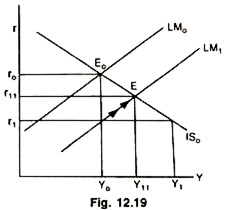

Result: People will sell bonds and thus asset price will fall leading to rise in interest rate. Thus, due to increase in demand for money the interest rate will increase and, thus, move up on the LM 1 curve till a new equilibrium point is reached. This is at point E 2.. Thus, At point E 2: both product and money market is in equilibrium (IS = LM,).

If you’ve got money to invest and you’re considering a money market account, you need to know about current money market rates and other key details. Will a money market account give you the best return for your money? Is it worth your time...

In theory, a sufficiently negative rate of interest could restore a full employment, noninflationary equilibrium. I think that’s the market monetarist solution. But it might not work out so well. Debt is a particular and problematic institution. If savers must pay borrowers for the privilege of carrying forward wealth, it... strategy is to expose it for the nonsense... if the “natural” nominal rate of interest goes/wants to go...

Refer to the above diagram of the market for money. The vertical money supply curve Sm reflects the fact that: the stock of money is determined by the Federal Reserve System and does not change when the interest rate changes.

The equilibrium rate of interest in the market for money is determined by the intersection of the: supply-of-money curve and the asset-demand-for-money curve. supply-of-money curve and the transactions-demand-for-money curve. supply-of-money curve and the total-demand-for-money curve. investment-demand curve and the total-demand-for-money curve.

Money market accounts have provided some of the best interest rates for short term savings for years. Our list of top MMA banks will help you find the best interest rates for your needs. Holly Johnson | August 20, 2021 Money market accounts...

If you’ve been watching your savings account, you may have noticed falling interest rates over the past year. Rates may be impacted by factors like the economy and rates among competing banks. The biggest influence on rates, though, is the ...

Refer to the market for money diagram below.Other things being equal, if the Bank of Canada increases the stock of money, the: 11eacf22_e8a2_7529_aab5_51eae88d9e9b_TB6686_00 A)S curve would shift leftward and the equilibrium interest rate would rise. B)S curve would shift rightward and the equilibrium interest rate would fall. C)D would shift leftward and the equilibrium interest rate would fall.

Looking at the IS-LM diagram first; a monetary expansion causes the money supply to rise from M 0 to M 1, and so the LM Curve shifts from LM 0 to LM 1.The new equilibrium is at A 1, with a consequent rise in the output level and a fall in the interest rate. This causes the AD curve to shift to the right, with the price level rising from P

The real money demand function with GNP level Y $ 1 intersects with real money supply at point G 1 in the money market diagram determining the interest rate i $ 1. The interest rate in turn determines RoR $ 1, which intersects with RoR £ at point G 2, determining the equilibrium exchange rate E $/£ 1.

Since the interest rate is identical to the rate of return on dollar assets from a U.S. dollar holder's perspective (i.e., RoR $ = i $), we can now place the RoR diagram directly on top of the rotated money market diagram as shown in Figure 7.8 "Money-Forex Diagram".The equilibrium interest rate (i′ $), shown along the horizontal axis above the rotated money market diagram, determines the ...

Economics questions and answers. 27) 2 Quantity of Money Refer to the diagram of the market for money. The equilibrium interest rate is A) /3. C) /2. D) not determinable without additional information. 28) Which of the following is an asset on the consolidated balance sheet of the Federal Reserve Banks?

1 The inadequacies of Australian indexation arrangements 1 1.2 For many, being on allowances is far from temporary 3 1.3 Do allowances encourage people to be unemployed? 4 1.4 How many people are on Newstart? 4 1.5... Computable general equilibrium modelling 54 Limitation of our work 55 Analysis of the impact of raising benefit...

D) output level that is too low to maintain equilibrium in the goods market with an interest rate of 7%. Byeha Diff: 2 Topichappendix: The IS-LM Diagram Skillhaonceptual AACSB: Reflective Thinking 2 Ha/Ha 1) The IS curve shows combinations of income and interest rates consistent with equilibrium in the money market.

In an ideal world, we would all find a way to make our money that is sitting in our banks work for us rather than, well, just sit there. One of the ways we can do that is by placing our money in accounts that offer a decent Annual Percentag...

Q. Refer to the figure below. Suppose the interest rate is initially at 4%. In this case, the quantity of loanable funds supplied is _____ than the quantity of loans demanded. This would encourage lenders to _____ the interest rate they charge, moving the market toward the equilibrium interest rate of _____.

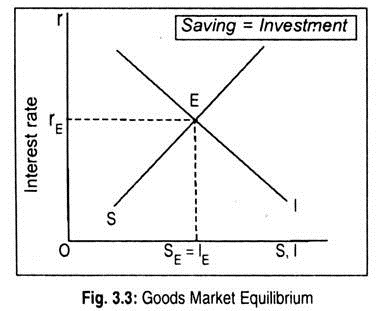

The interest rate and the income level should be such that both the markets are in equilibrium. The IS-LM shows the interaction between the goods and the money market. The model finds the value of income and the interest rate which simultaneously clears the goods and the money market.

If the interest rate is above the equilibrium rate, there will be an _____ money and the interest rate will _____. A. excess demand for; rise B. excess supply of; fall C. excess demand for; fall D. excess supply of; rise E. excess supply of; remain the same 35. Use the "Money Market II" Figure 28-1. If the rate of interest is below the ...

Chapter 12. Aggregate Demand in the Goods and the Money Markets. 1.The axes of the goods market-money market graph in Chapter 12 (the IS-LM graph) are real GDP or income on the horizontal axis and the interest rate on the vertical axis. TRUE 2.An increase in the money supply will lead to a shift down and to the right of the money-market (LM ...

Many people are familiar with checking and saving accounts, but money market accounts are an additional method of storing money with a bank. Money market accounts blend some of the abilities of both checking and savings accounts. They usual...

constrained to a point where their capacity to meet current and future needs is seriously jeopardized. Constraints may be further exacerbated by unsustainable agricultural practices, social and economic pressures and the impact of climate change. THE STATE OF THE WORLD’S LAND AND WATER RESOURCES FOR FOOD AND AGRICULTURE...

Refer to the above diagram of the market for money. Given Dm and Sm, an interest rate of i3 is not sustainable because the: A. supply of bonds in the bond market will decline and the interest rate will rise. B. supply of bonds in the bond market will increase and the interest rate will decline.

Figure 1. Refer to this diagram of the open-economy macroeconomic model to answer the questions below. (see notes) Refer to Figure 1. At an interest rate of 4 percent, the diagram indicates that. a. there is a surplus in the market for foreign-currency exchange. b. national saving equals domestic investment.

The term “inflation” has been all over the news lately — and it won’t be the last time we hear it either. Even though it’s a fairly common term, what, exactly, does “inflation” mean? And how does it relate to interest rates? Here, we’ll bre...

8 According to industry lobbyists such as the Electronic Frontier Foundation “[w]e happen to be at a special point in time when every branch of government is itching for patent reform.” 9 I demonstrate that contrary to these assertions, patents create economic benefits because the market for inventions generates efficient...

is possible (). Recovered monomers can be remanufactured into the same PDK resin in a fully closed loop or upcycled out of loop with other monomers to access new features without affecting their future prospects for... as the scaling challenges associated with introducing a new, more recyclable polymer resin into the market. A...

Find all the best Money Market Rates for 2021. A Money Market Account (MMA) is a type of savings account that usually earns a higher amount of interest than a basic savings account. Hustler Money Blog Best Bank Bonuses and Promotions By Ant...

Williams: Federal Reserve Bank of San Francisco, 101 Market St., San Francisco, CA 94105; email: john.c.... for the economy, asset prices, and monetary policy. A great deal has been written on why the equilibrium or... level of potential GDP, which is assumed to be unrelated to the real interest rate for this diagram. In...

In any market, an equilibrium occurs when the quantity supplied is equal to the quantity demanded. Prices adjust until the market is in equilibrium. The money market is no exception. The only difference between the markets we saw in Unit 1 and the money market is: The price is the nominal interest rate The supply curve is vertical.

The interest rate falls: 0.5 = Hs = Hd = 3.68 - 18.4i i=17.28% The increased supply of high-powered money requires the interest rate be lowered to spur demand for high-powered money (market clearing). At a lower interest rate consumers will demand more money, as the opportunity cost of holding money has declined.

Refer to the graph below, in which D t is the transactions demand for money, D m is the total demand for money, and S m is the supply of money. If the market for money is in equilibrium at a 6 percent rate of interest and the money supply increases, then S m2 will shift to: A) S m3 and the interest rate will be 4 percent. B) S m3 and the interest rate will be 8 percent.

0 Response to "40 refer to the diagram of the market for money. the equilibrium interest rate is"

Post a Comment